What is Medi-Share?

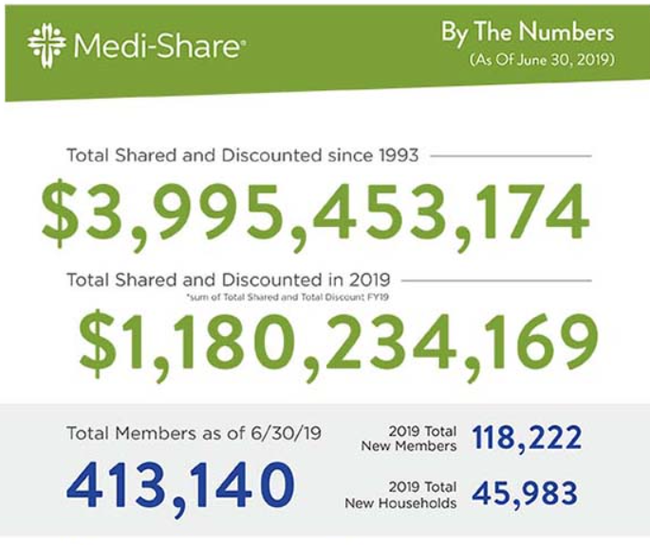

Medi-Share is a Christian healthcare sharing program where members share the medical expenses of other members while paying a low amount each month. It has been operating continuously since 1993 and has over 400,000 active members.

I am writing this up-to-date 2024 review based on my nine years of experience as a member of Medi-Share.

I am writing this up-to-date 2024 review based on my nine years of experience as a member of Medi-Share.

How does Medi-Share work?

When you join Medi-Share, you select your desired Annual Household Portion (AHP) which works just like a deductible does for traditional insurance. You then make monthly payments that typically cost around 60% less than your premiums would be with normal health insurance (more on cost below).

Here is the process for when you or a family member need to see a doctor or specialist:

So long as you've paid more than your AHP in the past year, Medi-Share simply pays the bill for you using the monthly shares of other members. If you haven't yet reached your AHP, then they negotiate the best discount they can and you pay the remainder.

For example, if your AHP is $3,000 and you have spent more than this amount on medical bills in the past year, then subsequent visits will cost only the $35 copay.

Here is the process for when you or a family member need to see a doctor or specialist:

- Go to your current healthcare provider;

- Or do an online search for doctors in Medi-Share’s substantial PHCS network

- Choose your preferred nearby doctor or specialist

- Show the doctor’s office your Medi-Share Member’s card

- Pay the $35 Copay

- They submit the bill directly to Medi-Share

So long as you've paid more than your AHP in the past year, Medi-Share simply pays the bill for you using the monthly shares of other members. If you haven't yet reached your AHP, then they negotiate the best discount they can and you pay the remainder.

For example, if your AHP is $3,000 and you have spent more than this amount on medical bills in the past year, then subsequent visits will cost only the $35 copay.

Who is allowed to join Medi-Share?

Membership is open to all Christians who live in accordance with good Christian values. You won't be asked to provide proof of your faith, but Medi-Share works because it is a community of like-minded members with similar beliefs and morals.

How much does Medi-Share cost?

See our cost comparison page for a full answer to this question on Medi-Share pricing.

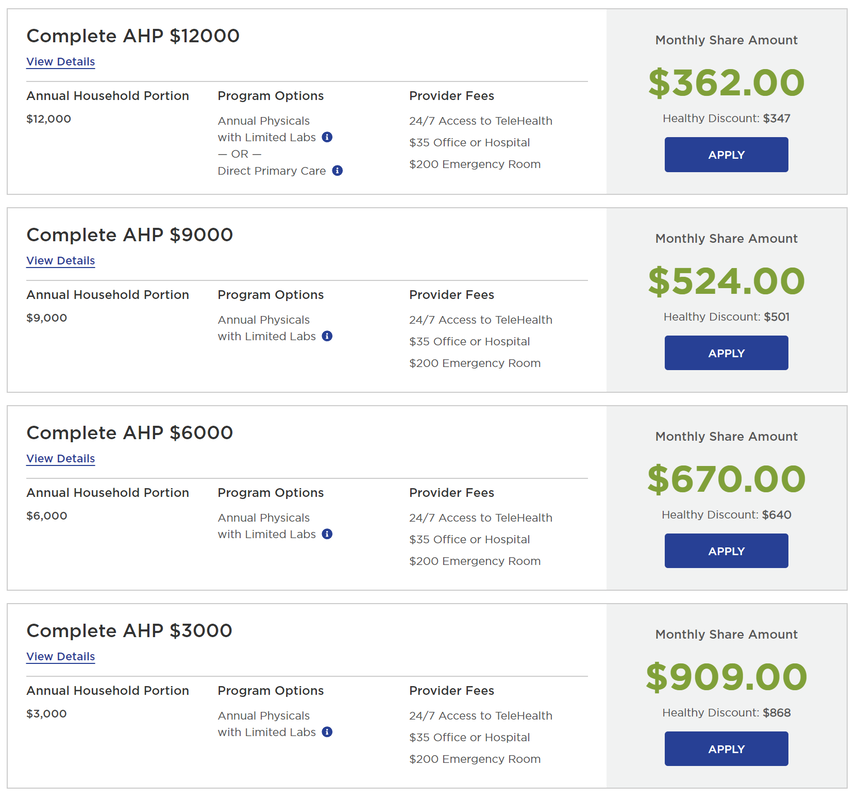

The short version is that your monthly payment will depend on your family status, age, health, location, and desired AHP (the Annual Household Portion which is just like a deductible). For example, suppose you and your spouse are 40 years old and have three children. You'll have options ranging from around $362 to $909 per month with pricing differences based on your location. This monthly payment covers you and your entire family.

The short version is that your monthly payment will depend on your family status, age, health, location, and desired AHP (the Annual Household Portion which is just like a deductible). For example, suppose you and your spouse are 40 years old and have three children. You'll have options ranging from around $362 to $909 per month with pricing differences based on your location. This monthly payment covers you and your entire family.

(The "Co-Sharing" options offer a monthly discount, and in exchange you continue to pay 30% of your bills up to a maximum of $10,000 even after you've reached your AHP.)

How much will I save with Medi-Share?

In the chart above, we see that a healthy 40-year-old with a family of 5 will pay $362 per month for a $12000 AHP (deductible). A similar plan averages around $1830 per month across states on Healthcare.gov.

Of course, it's important to make an apples to apples comparison. Traditional health insurance may have benefits including lower copays and the ability to deduct monthly premiums. Including all factors, we believe the average family saves 60-65% per year with Medi-Share. This will usually come out to being somewhere between $2,500 and $10,000 per year in savings.

For our family, my calculation is that we save around $4,800 per year -- a 63% discount relative to our past health insurance.

Of course, it's important to make an apples to apples comparison. Traditional health insurance may have benefits including lower copays and the ability to deduct monthly premiums. Including all factors, we believe the average family saves 60-65% per year with Medi-Share. This will usually come out to being somewhere between $2,500 and $10,000 per year in savings.

For our family, my calculation is that we save around $4,800 per year -- a 63% discount relative to our past health insurance.

How is Medi-Share able to charge so much less?

With conventional insurance, a significant part of what you are paying is the insurance company's profit. There's a reason that Warren Buffett became one of the wealthiest men alive largely through the insurance business. Insurance companies also hire teams of actuaries and investment experts in addition to facing substantial regulatory costs which are passed on to their customers.

By contrast, Medi-Share is simply a non-profit organization dedicated to helping Christians get their medical bills paid.

By contrast, Medi-Share is simply a non-profit organization dedicated to helping Christians get their medical bills paid.

Are there any complaints about Medi-Share?

While we have had only excellent experiences with Medi-Share, here are a few important notes to keep in mind.

First, medical expenses going against a Christian way of life aren't covered. These include drug abuse recovery, getting in a car accident with alcohol in your blood, or abortion. Second, your monthly payments are not tax deductible, like they usually will be with conventional health insurance premiums. And lastly, pre-existing conditions will usually not be eligible for sharing.

Medi-Share remains in good standing in all fifty states. If you have had any problems with Medi-Share, please email me and I can try to help as well as add them to this section.

First, medical expenses going against a Christian way of life aren't covered. These include drug abuse recovery, getting in a car accident with alcohol in your blood, or abortion. Second, your monthly payments are not tax deductible, like they usually will be with conventional health insurance premiums. And lastly, pre-existing conditions will usually not be eligible for sharing.

Medi-Share remains in good standing in all fifty states. If you have had any problems with Medi-Share, please email me and I can try to help as well as add them to this section.

Am I allowed to see my normal doctor or medical provider?

Yes, but you pay less if you use a doctor or specialist who is part of Medi-Share's vast PHCS network of medical providers.

When you become a member, you'll have access to the online Member's Section where you can search for in-network doctors near you, including those with any specialty such as pediatricians or cardiac surgeons.

Also, along with dental and vision discounts, Medi-Share now offers free 24/7 online doctor appointments to all members. See our blog for more details.

When you become a member, you'll have access to the online Member's Section where you can search for in-network doctors near you, including those with any specialty such as pediatricians or cardiac surgeons.

Also, along with dental and vision discounts, Medi-Share now offers free 24/7 online doctor appointments to all members. See our blog for more details.

Is Medi-Share Christian Health Insurance?

Interestingly, the term Christian health insurance doesn't actually mean health insurance for Christians. Insurance is a heavily regulated for-profit trillion dollar industry. When you buy insurance, the insurance companies see you as a way to generate cash flow by taking in your premiums and investing them. They are incentivized to take in as much as possible, and pay out as little as possible.

Christian healthcare sharing is a non-profit alternative where members share each other's medical bills. As Christian personal finance expert Dave Ramsey discusses, Medi-Share has a decades-long track record of reliably getting medical bills paid for its members. Since the release of this infographic, the total amount of shared medical bills is up to around $6 billion.

Christian healthcare sharing is a non-profit alternative where members share each other's medical bills. As Christian personal finance expert Dave Ramsey discusses, Medi-Share has a decades-long track record of reliably getting medical bills paid for its members. Since the release of this infographic, the total amount of shared medical bills is up to around $6 billion.

Our personal experiences with Medi-Share

When my wife and I discovered Medi-Share, we joined primarily because it made financial sense to do so. Instead of paying the large and growing Obamacare penalty, or paying the significantly more expensive premiums we were seeing on Esurance, we could get a discount of over 60% while supporting a network of fellow Christians.

As we continued being members, we found more and more we appreciated about Medi-Share. Its customer service has been exceptional from the start. When you call the number on the card, you're quickly connected to a customer service agent who speaks fluent English. The staff is easy to reach, empowered to help you, and always happy to answer questions and take prayer requests.

The actual healthcare sharing process is extremely simple. You show your membership card at the doctor's office, and they send your bill directly to Medi-Share. You just pay the provider fee (copay). If you're over your AHP (deductible), they pay the bill. If you're under, then you pay the discounted rate they negotiate for you.

The system has been fully reliable for us, and a tremendous blessing for our family and the 400,000 others who have been relying on it each month for affordable healthcare since Medi-Share opened their doors as a non-profit 29 years ago.

As we continued being members, we found more and more we appreciated about Medi-Share. Its customer service has been exceptional from the start. When you call the number on the card, you're quickly connected to a customer service agent who speaks fluent English. The staff is easy to reach, empowered to help you, and always happy to answer questions and take prayer requests.

The actual healthcare sharing process is extremely simple. You show your membership card at the doctor's office, and they send your bill directly to Medi-Share. You just pay the provider fee (copay). If you're over your AHP (deductible), they pay the bill. If you're under, then you pay the discounted rate they negotiate for you.

The system has been fully reliable for us, and a tremendous blessing for our family and the 400,000 others who have been relying on it each month for affordable healthcare since Medi-Share opened their doors as a non-profit 29 years ago.

Find Out Your Exact Monthly Payment

Now that you have read this review and understand how Medi-Share works, a great next step is to click on the button below and fill out the short form to get your free information packet directly from Medi-Share. This packet is by far the best breakdown available of how much you'll pay each month for every option, exactly how the program works, and serves as a highly useful reference once you're a member.

We would also be grateful as our family receives a referral payment if you decide to join after clicking below and filling out the short form. These payments really help our family as well as give us the opportunity to make a monthly donation to Medi-Share's Extra Blessings program, helping pay the medical bills for other families in need.

We would also be grateful as our family receives a referral payment if you decide to join after clicking below and filling out the short form. These payments really help our family as well as give us the opportunity to make a monthly donation to Medi-Share's Extra Blessings program, helping pay the medical bills for other families in need.

(Fill Out This 30-Second Form To See What Your Exact Monthly Savings Would Be)