We will now compare the cost of Medi-Share vs conventional health insurance across different ages, marital statuses, and family sizes. As discussed in our main Medi-Share review, the Annual Household Portion works like a deductible. Note that the costs below will vary based on factors such as your location, when you sign up, and the optional Health Incentive discount.

(The "Co-Sharing" rates are another optional discount: You can choose to pay 30% of your medical bills -- up to $10,000 total -- when you're above the AHP, and in exchange pay less each month. It works similar to coinsurance in some traditional health insurance plans.)

Of course, it's not easy to give an exact price comparison for different types of health insurance that will have different levels of coverage, deductibles, and other features. Nonetheless the numbers on this page offer a good basic comparison of the cost difference between normal health insurance and Medi-Share's Christian health insurance alternative. The quotes for conventional insurance all come directly from the official healthcare.gov site for current plans. They are the lower rates for non-smokers and come from different states across the country.

We'll finish with an estimate of total Medi-Share savings combining all factors.

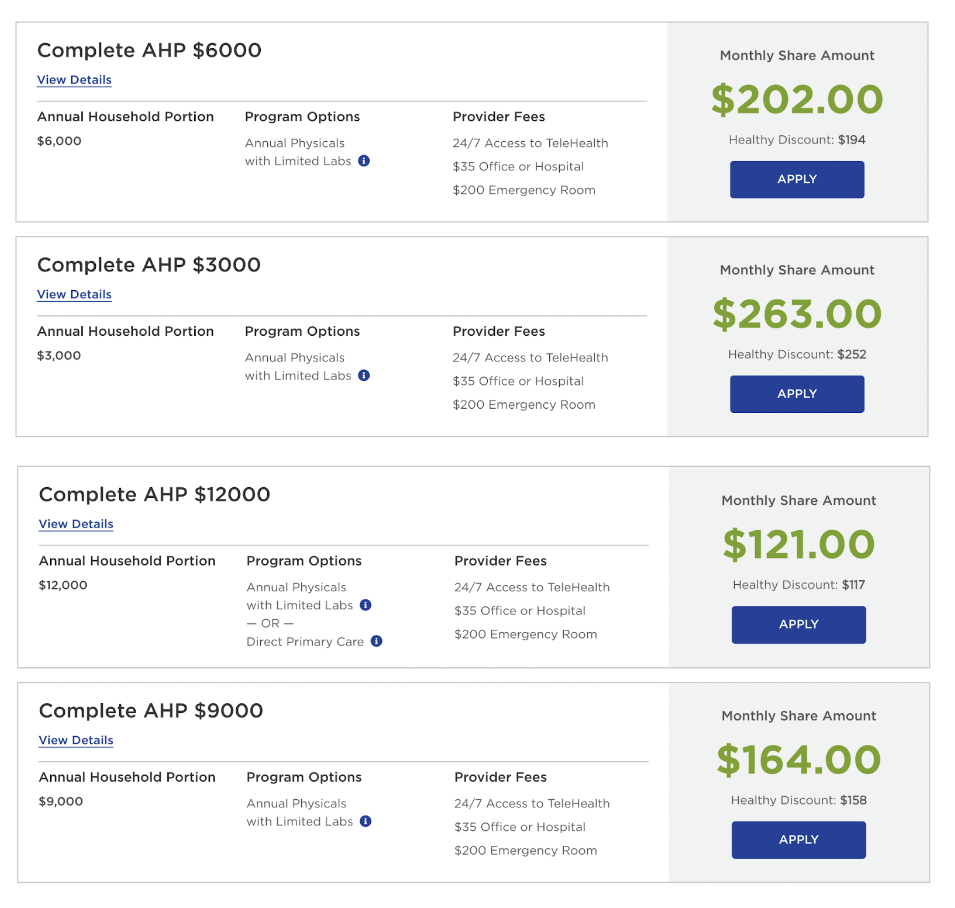

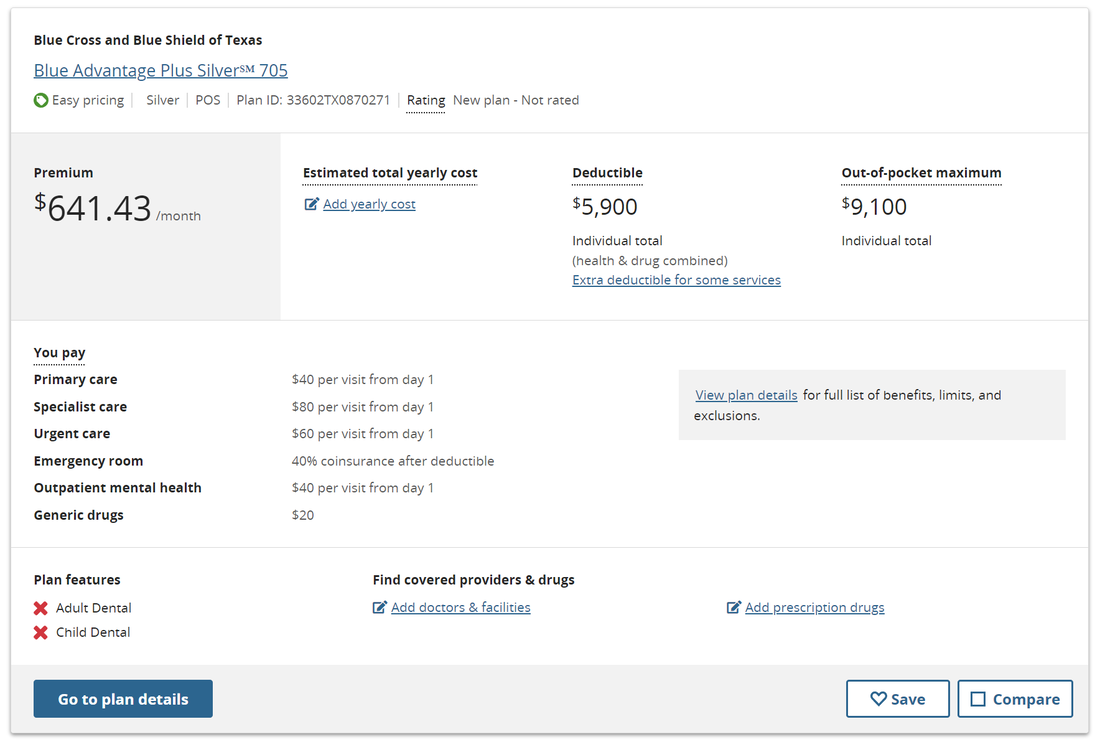

Medi-Share vs Conventional Insurance: Single 25 Year Old

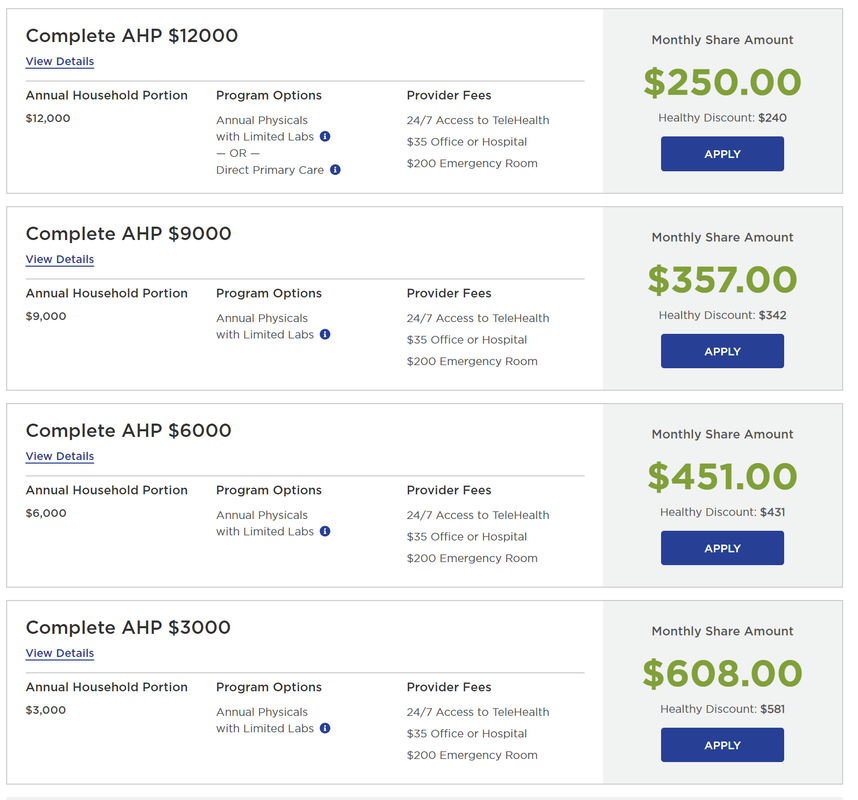

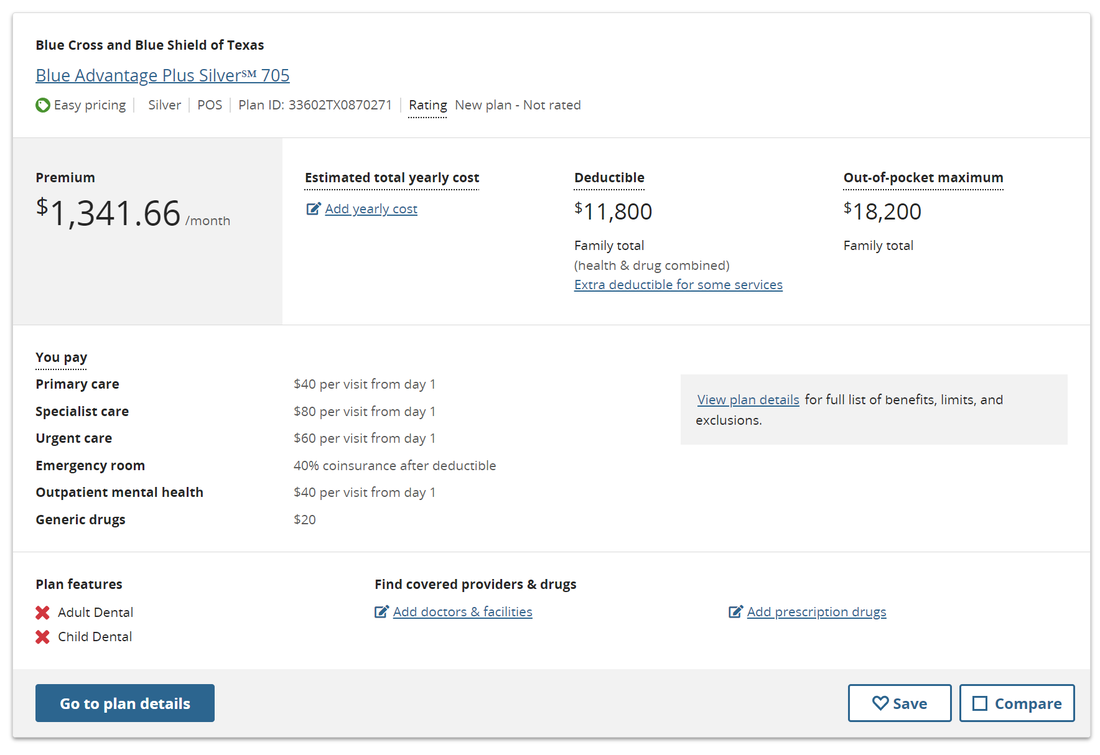

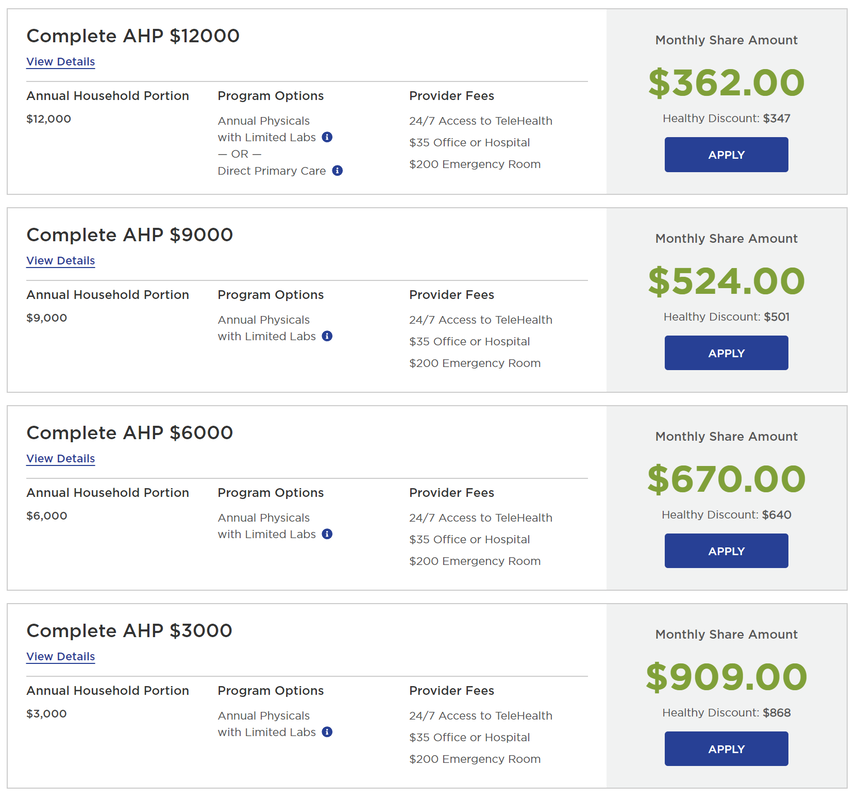

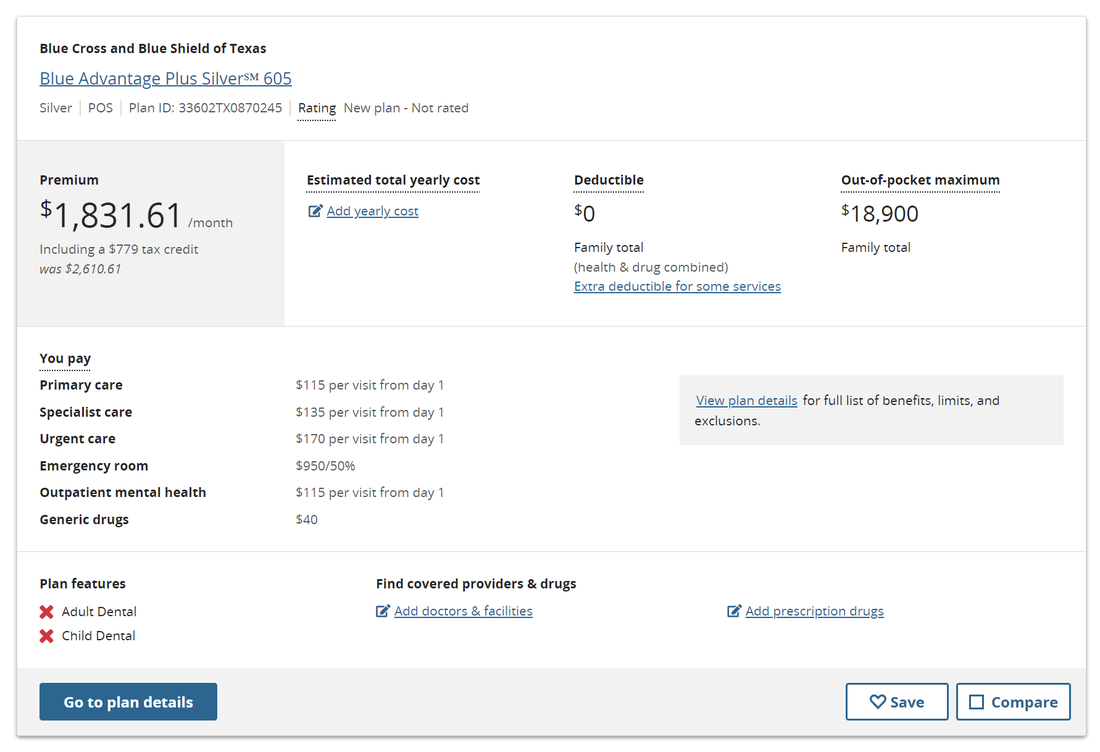

Medi-Share vs Conventional Insurance: Married 40 Year Old Couple

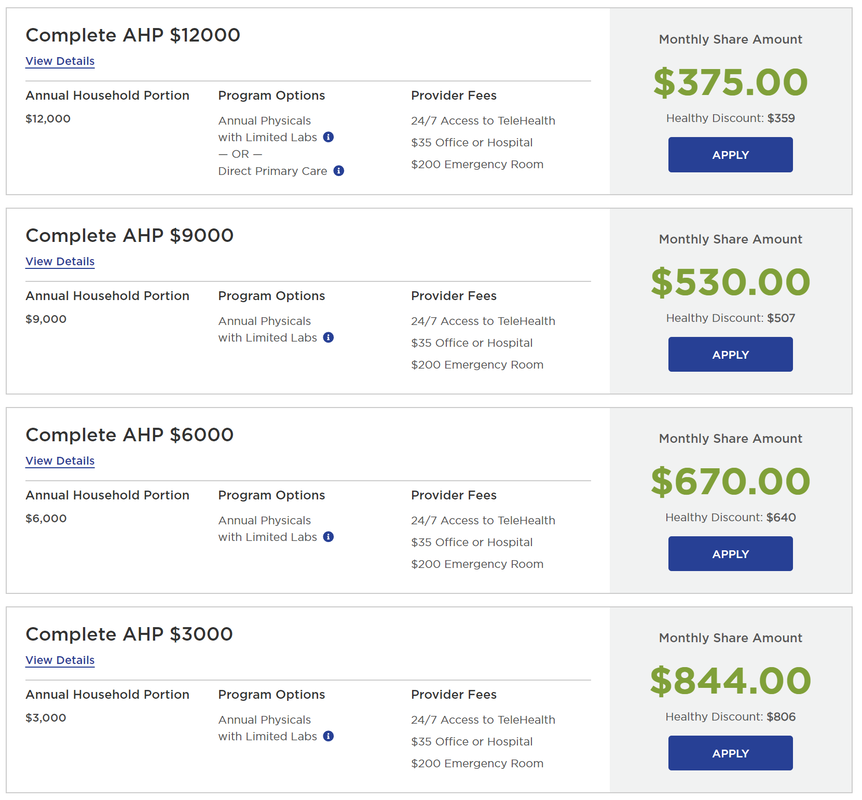

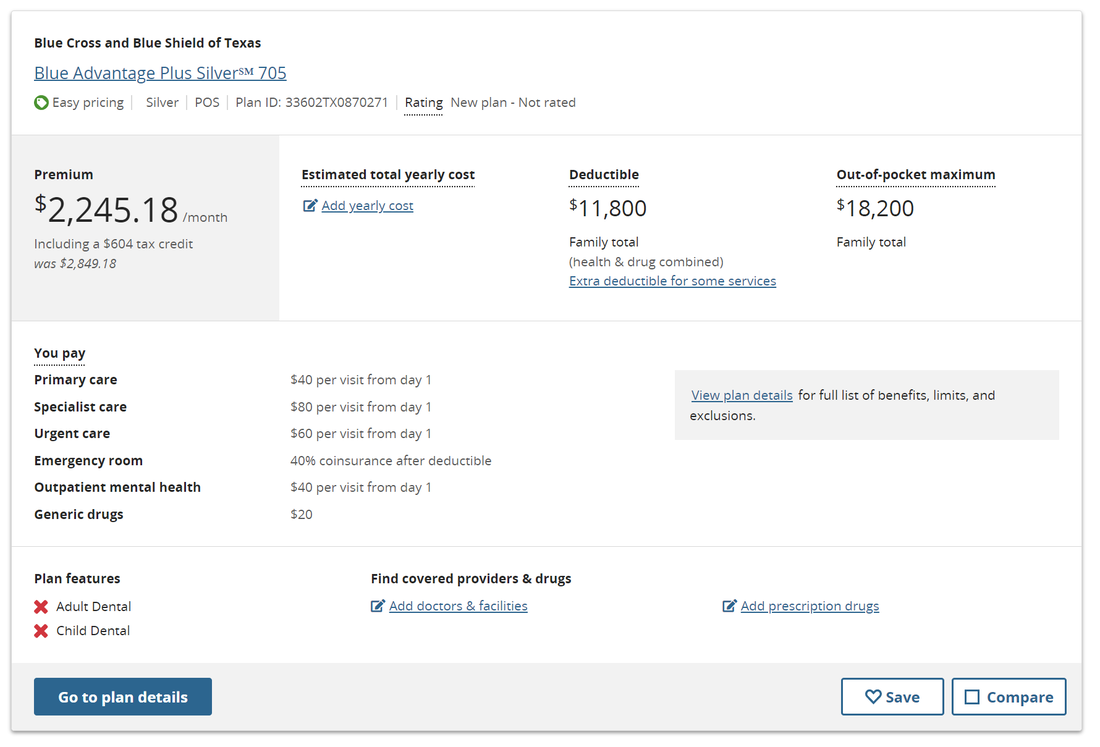

Medi-Share vs Conventional Insurance: Married 40 Year Old Couple, 3 Children

Medi-Share vs Conventional Insurance: Married 60 Year Old Couple

Conclusion on Price Difference

At first glance, for a given age, marital/family status, and deductible, conventional insurance tends to be over three times as expensive as Medi-Share. The true savings you'll enjoy with Medi-Share may average slightly less depending on several factors such as:

1. Copay. The copay for Medi-Share (called a provider payment or provider fee) is $35 for a doctor/hospital visit and $200 for an emergency room visit. Traditional insurance plans used to have lower copays but now tend to average a similar amount.

2. Routine Expenses. Medi-Share now has annual physicals eligible for sharing but doesn't cover as many routine/planned medical expenses compared to many insurance plans.

3. Taxes. Monthly share payments with Medi-Share are not tax-deductible like they usually are with conventional insurance.

On the flip side, factors such as superior customer service and 24/7 online doctor appointments are significant benefits of Medi-Share in addition to the much lower price. Medi-Share also negotiates a substantial discount when you're paying out-of-pocket before reaching your annual household portion (deductible).

Combining all these factors, our estimate is that the average family will save around 60-65% each year with Medi-Share compared to conventional insurance. In terms of a dollar figure, this makes the annual savings through Medi-Share somewhere between $2000 and $12,000, with most families saving an average of around $5,000 per year.

Our own savings as Medi-Share members have been tremendously helpful for us: we estimate that combining all factors, we have saved almost $30,000 in our six years of membership relative to our previous health insurance.

1. Copay. The copay for Medi-Share (called a provider payment or provider fee) is $35 for a doctor/hospital visit and $200 for an emergency room visit. Traditional insurance plans used to have lower copays but now tend to average a similar amount.

2. Routine Expenses. Medi-Share now has annual physicals eligible for sharing but doesn't cover as many routine/planned medical expenses compared to many insurance plans.

3. Taxes. Monthly share payments with Medi-Share are not tax-deductible like they usually are with conventional insurance.

On the flip side, factors such as superior customer service and 24/7 online doctor appointments are significant benefits of Medi-Share in addition to the much lower price. Medi-Share also negotiates a substantial discount when you're paying out-of-pocket before reaching your annual household portion (deductible).

Combining all these factors, our estimate is that the average family will save around 60-65% each year with Medi-Share compared to conventional insurance. In terms of a dollar figure, this makes the annual savings through Medi-Share somewhere between $2000 and $12,000, with most families saving an average of around $5,000 per year.

Our own savings as Medi-Share members have been tremendously helpful for us: we estimate that combining all factors, we have saved almost $30,000 in our six years of membership relative to our previous health insurance.

Find Out Exactly How Much You'll Save with Medi-Share

Click on the button below and fill out the short form to get your free information packet directly from Medi-Share. This packet is by far the best breakdown available of how much you'll pay each month for every option, exactly how the program works, and serves as a highly useful reference once you're a member.

We would also be grateful as our family receives a referral payment if you decide to join after clicking below and filling out the short form. These payments really help our family as well as give us the opportunity to make a monthly donation to Medi-Share's Extra Blessings program, helping pay the medical bills for other families in need.

We would also be grateful as our family receives a referral payment if you decide to join after clicking below and filling out the short form. These payments really help our family as well as give us the opportunity to make a monthly donation to Medi-Share's Extra Blessings program, helping pay the medical bills for other families in need.

(Fill Out This 30-Second Form To See What Your Exact Monthly Savings Would Be)